Best State in Which to Register a 501 C 3

The parent organizations group exemption meets the exemption requirements from. Or maybe you are already operating a nonprofit but need a better understanding of how to stay in compliance.

The Ultimate Guide To Registering A 501 C 19 Nonprofit Organization

Ad We Make It Easy To Incorporate With Step-By-Step Guidance.

. Some organizations are tax-exempt as nonprofit organizations but lack the 501c3 status as a charitable organization. The 401 IRS designation refers to qualified pension profit-sharing and stock bonus plans. 5 Best States to Start a Nonprofit 1.

I was turned down both time because I. Most states also exempt 501c3s from paying state income taxes. To create a 501 c 3 tax-exempt organization first you need to form a nonprofit corporation under Delaware state law.

As a result states without taxes such as Nevada could leverage the appeal of no such additional filing requirement. No income since it was formed. File articles of incorporation and pay a registration fee which varies from state to state.

Incorporate Your Business Today. These differ from the unique provision of 501c3 in that contributions to the organization would not be tax deductible to the giver. However if you choose to register with the IRS as a 501c3 by preparing Form 1023 you would then need to prepare the annual 990 return in order to maintain this status.

This registers the 501 c 3 with your states secretary of state. Keep reading to learn more. Answer 1 of 8.

The c part of a 401 designation refers to self-employed indi. To get started helping others however their organizers must first set up and register the organization with the appropriate authorities. For nonprofits in Wyoming and elsewhere obtaining 501c3 tax-exempt status is no small feat.

Best practices and samples. Several other states require a separate application but. The state of Delaware is home to more than 5500 nonprofit organizations including more than 3000 501c3 public charities.

Churches sometimes choose to do this if they need the formal status to qualify for discounts or benefits for tax-exempt orgs qualify for state programs for 501c3s and. Its a common mistake people make accidentally putting a 4 instead of a 5. The organization is a recognized subordinate under the parent organizations group exemption.

501 c 3 4 8 10 or 19 A 501 cs exemption from certain state taxes is based largely on an organizations affiliation with its parent entity assuming that. Most nonprofits are 501 c 3 organizations which means they are formed for religious charitable scientific literary or educational purposes and are eligible for federal and state tax exemptions. In addition it may not be an action organization ie it may not attempt to influence legislation as a.

California and Texas are big exceptions requiring their own application process for charity status in their state. Incorporate your nonprofit organization. My Charity is Kids Need Help Inc.

A 401c 3 is not a non-profit. Forming and Maintaining a Nonprofit State by State Guide. So which is the best state to start a nonprofit.

As you might imagine many people think that all nonprofits are tax-exempt and to some extent in Wyoming this is true. California has a state tax exemption application separate from the 501c3 tax-exempt status process with the IRS. To be tax-exempt under section 501c3 of the Internal Revenue Code an organization must be organized and operated exclusively for exempt purposes set forth in section 501c3 and none of its earnings may inure to any private shareholder or individual.

There are a number of steps involved in being properly established and in compliance with federal and state laws. A religious purpose is one of the seven exempt purposes specified in Section 501c3 of the Internal Revenue Code the Code. A multi-page form FTB 3500.

The National Council of Nonprofits is a proud 501c3 charitable nonprofit. The application must be submitted electronically on wwwpaygov and must including the appropriate user fee. Most states recognize the federal 501c3 status as valid for state corporate tax exemption.

I was told by the IRS that I could do a 1023EZ form which I submitted on two occasions. See Application Process for a step-by-step review of what an organization needs to know and to do in order to apply for recognition. You have an idea and a vision to form a nonprofit organization.

The majority of states require charitable nonprofits that are engaged in soliciting donations to register with the state to report on the nonprofits fundraising activities. However unlike with the terms charitable educational and scientific the term religious is not defined in the Treasury Regulations in large part due to constitutional issues. Prior to 2008 there was only one option.

Wyoming corporations nonprofits are a type of corporation pay no state corporate tax. Our Focus Impact. The steps to form a 501 c 3 nonprofit corporation in Delaware.

Hello Bill I am trying to reinstate my 501c3 non profit charity. Our Focus Impact. So like a 401K.

Protect Your Business From Liabilities. However without a tax-exempt certification from the IRS every nonprofit even. To apply for recognition by the IRS of exempt status under section 501c3 of the Code use a Form 1023-series application.

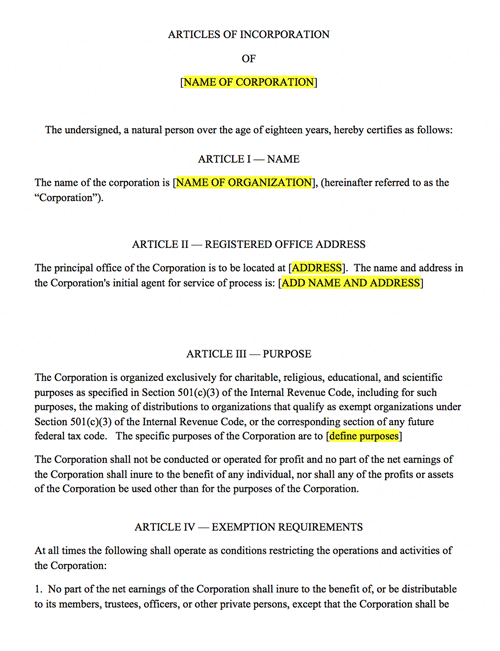

Nonprofit Articles Of Incorporation Harbor Compliance

List Of Top 15 Nonprofit Organizations In The Usa Usa Ngo

Mitoydna The New Y Dna And Mtdna Database Grandma S Genes Dna Database Dna Dna Test

Keystone Central School District Calendar Calendar Board School District High School Calendar

Do You Have A Great Idea For A Nonprofit Charitable Organization Do You Want T Start A Non Profit Nonprofit Startup Nonprofit Marketing

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

How To Set Up A Non Profit With 501 C 3 Status Start A Non Profit Non Profit Nonprofit Startup

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

How To Start A Nonprofit In California 14 Step Guide

Can An Llc Qualify As A Tax Exempt Nonprofit

Nonprofit Governance By State Harbor Compliance

North Carolina Nonprofit 501c3 Truic

How To Start A Nonprofit In The Usa 501 C 3 Step By Step Youtube

Bluehost Com Start A Non Profit Nonprofit Marketing Nonprofit Startup

Should A Nonprofit Organization Trademark Its Name Or Logo Nolo

Shop Support Donate Life America 5 Of My July Earnings Will Benefit Donate Life America This Amazing Charity Educat Donate Life Organ Donation Life

The Power Of The 501 C 3 Workshops On Mar 26 2016 With Workshop Presenter Aretha Olivarez Author Certified Nonprofit Consultant Ce Author Workshop Power

501 C 3 Rules And Regulations To Know Boardeffect

How To Start A Nonprofit Organization 501c3 Organization Youtube

Comments

Post a Comment